Is There A Cap On Inheritance Money Received From Insurance Policies

Synopsis

This plan provides financial assistance to the policyholder's family in the upshot of the policyholder'due south untimely death during the policy term, as well as periodic payments on the policyholder's survival for predetermined periods of time to meet a multifariousness of financial needs.

Getty Images

Getty Images has a new life insurance product called Bima Ratna, a not-linked, non-participating, individual savings life insurance product that combines protection and savings. The policy was launched on May 27, 2022.

Hither is a await at key details of the LIC Bima Ratna policy equally per the product brochure available on the LIC website.

Goal of the policy

This programme provides financial assistance to the policyholder'south family in the outcome of the policyholder's untimely death during the policy term, also as periodic payments on the policyholder's survival for predetermined periods of time to meet a variety of fiscal needs. Through a loan facility, this approach addresses liquidity concerns.

How to purchase LIC Bima Ratna

This product can be currently purchased through corporate agents, Insurance, marketing firms (IMF), brokers, CPSC-SPV and POSP-LI engaged by these intermediaries viz. corporate agents, insurance marketing firms (Imf) and brokers.

Death benefit

The "Sum Assured on Death" plus Accrued Guaranteed Additions will be paid on the decease of a Life Assured within the policy period following the date of the beginning of risk.

Where "Sum Bodacious on Expiry" means the higher of 125 pct of the Basic Sum Bodacious or seven times the yearly premium.

According to the LIC brochure, "This Expiry Benefit payment shall non be less than 105% of total premiums paid (excluding any actress premium, any passenger premium (due south) and taxes) upto date of death."

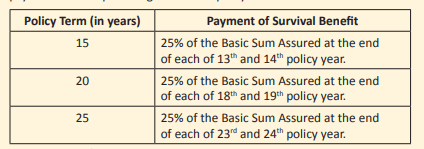

Survival Benefit

A specific proportion of the Basic Sum Assured volition exist paid if the life assured survives for each of the stated durations during the policy flow, providing the policy is in force.

Maturity Benefit

Co-ordinate to the LIC Bima Ratna brochure, "On Life Assured surviving the stipulated Date of Maturity provided the policy is in-force, "Sum Assured on Maturity" forth with accrued Guaranteed Additions, shall be payable. Where "Sum Bodacious on Maturity" is equal to 50% of Basic Sum Bodacious."

Guaranteed Additions

LIC will pay guaranteed increases of Rs 50 every Rs thou base sum assured from the first to the fifth year. From the 6th to the tenth policy year, LIC volition pay Rs 55 per Rs 1000 basic sum promised, and from the 11th to the 25th policy yr, the guaranteed increment will exist Rs threescore per Rs 1000 basic sum assured.

In the event of death while the insurance is all the same in force, the Guaranteed Addition in the year of death will exist for the entire policy twelvemonth.

The Guaranteed Additions under a policy will end accruing if the premiums are not paid on time.

The Guaranteed Addition for the policy year in which the last premium is received will be added proportionately in proportion to the premium received for that yr in the case of a paid-up policy or on surrender of a policy.

Date of commencement of chance

If the Life Assured's age at entry is less than eight years, the risk under this plan will begin 2 years from the date of first or 2 years from the policy anniversary coinciding with or immediately following the accomplishment of 8 years of age, whichever comes first.

Adventure will begin immediately for individuals who are 8 years quondam or older.

Date of vesting

"If the policy is issued on the life of a minor, the policy shall automatically vest on the Life Assured on the policy anniversary coinciding with or immediately following the completion of 18 years of age and shall on such vesting exist deemed to be a contract between the Corporation and the Life Assured," as per the LIC brochure.

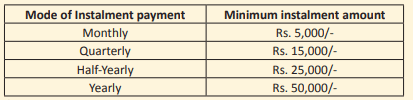

Settlement Choice

According to the LIC brochure copy, "LIC Settlement Option is an option to receive Maturity Benefit in instalments over a menses of 5 years instead of lump sum corporeality under an in-force as well as Paid-up policy. This option can be exercised past the Policyholder during minority of the Life Assured or by the Life Bodacious aged 18 years and above, for total or part of the maturity proceeds payable under the policy. The amount opted for this option by the Policyholder/ Life Bodacious (i.east. Cyberspace Merits Amount) can be either in accented value or as a percentage of the full claim proceeds payable."

Read the  now!

now!

Indulge in digital reading feel of ET paper exactly as it is.

Read Now

Read More News on

(Your legal guide on manor planning, inheritance, will and more.)

Download The Economic Times News App to get Daily Market Updates & Alive Business organization News.

Source: https://economictimes.indiatimes.com/wealth/insure/lic-bima-ratna-life-insurance-plan-9-things-to-know/articleshow/91883151.cms

Posted by: davenporttonse1938.blogspot.com

0 Response to "Is There A Cap On Inheritance Money Received From Insurance Policies"

Post a Comment